Pvm Accounting Things To Know Before You Get This

Pvm Accounting Things To Know Before You Get This

Blog Article

The 8-Minute Rule for Pvm Accounting

Table of Contents7 Easy Facts About Pvm Accounting DescribedPvm Accounting Can Be Fun For EveryoneSome Known Incorrect Statements About Pvm Accounting The Single Strategy To Use For Pvm AccountingWhat Does Pvm Accounting Mean?The Only Guide for Pvm Accounting

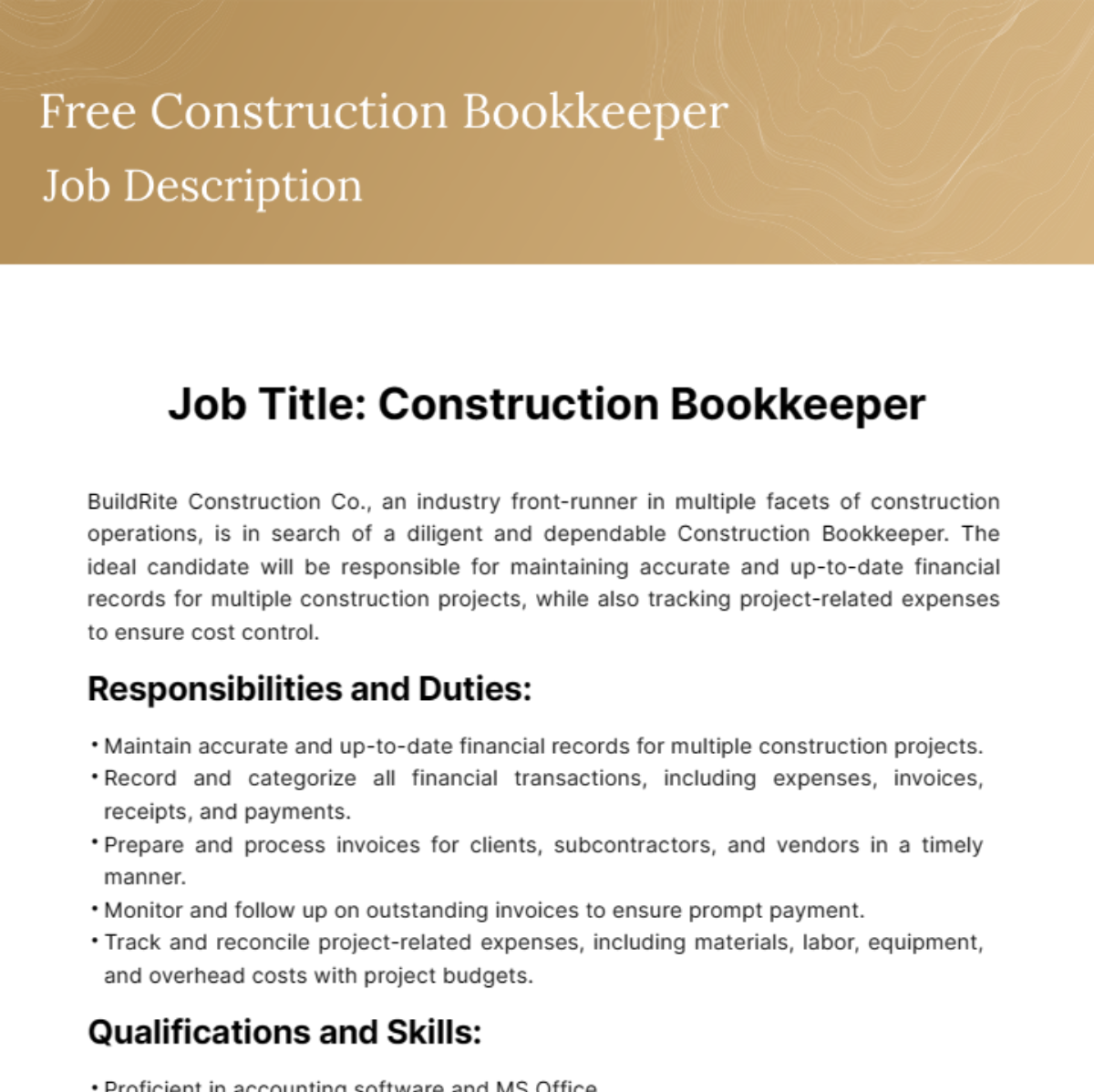

Make certain that the bookkeeping procedure abides with the law. Apply required building audit standards and procedures to the recording and reporting of construction task.Communicate with various funding firms (i.e. Title Firm, Escrow Company) concerning the pay application process and requirements needed for payment. Assist with implementing and maintaining inner economic controls and treatments.

The above declarations are planned to explain the general nature and level of work being performed by people appointed to this category. They are not to be understood as an extensive listing of responsibilities, duties, and abilities called for. Employees might be required to perform obligations beyond their normal responsibilities every so often, as needed.

The Main Principles Of Pvm Accounting

You will aid support the Accel group to guarantee distribution of successful promptly, on budget plan, tasks. Accel is seeking a Building and construction Accountant for the Chicago Workplace. The Construction Accounting professional performs a range of bookkeeping, insurance conformity, and task administration. Functions both individually and within particular divisions to maintain monetary documents and make certain that all documents are maintained current.

Principal tasks consist of, but are not limited to, managing all accounting features of the business in a timely and precise fashion and providing reports and routines to the business's certified public accountant Firm in the preparation of all monetary statements. Makes sure that all audit treatments and features are handled precisely. Accountable for all economic documents, pay-roll, financial and day-to-day operation of the accounting function.

Functions with Job Supervisors to prepare and publish all regular monthly invoices. Creates regular monthly Job Price to Date reports and working with PMs to integrate with Job Supervisors' budget plans for each project.

The 5-Second Trick For Pvm Accounting

Effectiveness in Sage 300 Building and Property (formerly Sage Timberline Workplace) and Procore building and construction administration software program a plus. https://giphy.com/channel/pvmaccounting. Need to also be skillful in other computer system software systems for the preparation of records, spreadsheets and other bookkeeping evaluation that might be required by administration. financial reports. Should have solid organizational skills and capability to focus on

They are the economic custodians who guarantee that building tasks continue to be on budget, follow tax obligation laws, and keep financial transparency. Building accounting professionals are not simply number crunchers; they are strategic partners in the building procedure. Their key duty is to take care of the financial aspects of construction jobs, ensuring that resources are designated effectively and monetary risks are reduced.

Pvm Accounting for Dummies

By keeping a tight grip on task financial resources, accountants aid protect against overspending and monetary setbacks. Budgeting is a keystone of successful building and construction jobs, and construction accounting professionals are important in this respect.

Building accountants are skilled in these laws and ensure that the project conforms with all tax obligation demands. To succeed in the duty of a construction accountant, individuals need a solid academic foundation in accountancy and financing.

Furthermore, qualifications such as Licensed Public Accountant (CPA) or Qualified Building And Construction Market Financial Expert (CCIFP) are highly regarded in the sector. Building and construction jobs typically involve tight target dates, altering policies, and unanticipated costs.

Get This Report on Pvm Accounting

Ans: Construction accounting professionals create and check budgets, identifying cost-saving chances and guaranteeing that the task stays within spending plan. Ans: Yes, construction accounting professionals click here for more info manage tax obligation compliance for building projects.

Introduction to Building And Construction Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction companies need to make challenging selections among lots of economic alternatives, like bidding on one project over one more, picking financing for materials or tools, or establishing a project's revenue margin. Construction is an infamously unpredictable industry with a high failure rate, slow-moving time to settlement, and inconsistent cash flow.

Typical manufacturerConstruction organization Process-based. Production entails repeated procedures with easily recognizable costs. Project-based. Manufacturing needs various processes, products, and equipment with differing costs. Taken care of location. Production or manufacturing occurs in a solitary (or several) regulated locations. Decentralized. Each job takes place in a brand-new location with varying website conditions and special challenges.

Excitement About Pvm Accounting

Long-lasting relationships with vendors ease negotiations and improve effectiveness. Inconsistent. Frequent use of different specialty professionals and providers impacts effectiveness and money flow. No retainage. Payment arrives completely or with regular payments for the complete agreement quantity. Retainage. Some part of repayment may be withheld until project conclusion also when the specialist's work is completed.

While traditional suppliers have the advantage of regulated settings and enhanced manufacturing processes, building firms must regularly adjust to each new job. Also somewhat repeatable projects need alterations due to site conditions and various other variables.

Report this page